Welcome back to the second post in this series. Today we will be discussing GSTR-1 JSON creation and upload of JSON to the GSTN portal.

You can either go ahead and read the post or watch the videos in which we have shown how to do the processes.

In the previous step, we have entered or imported the data to Saral GST.

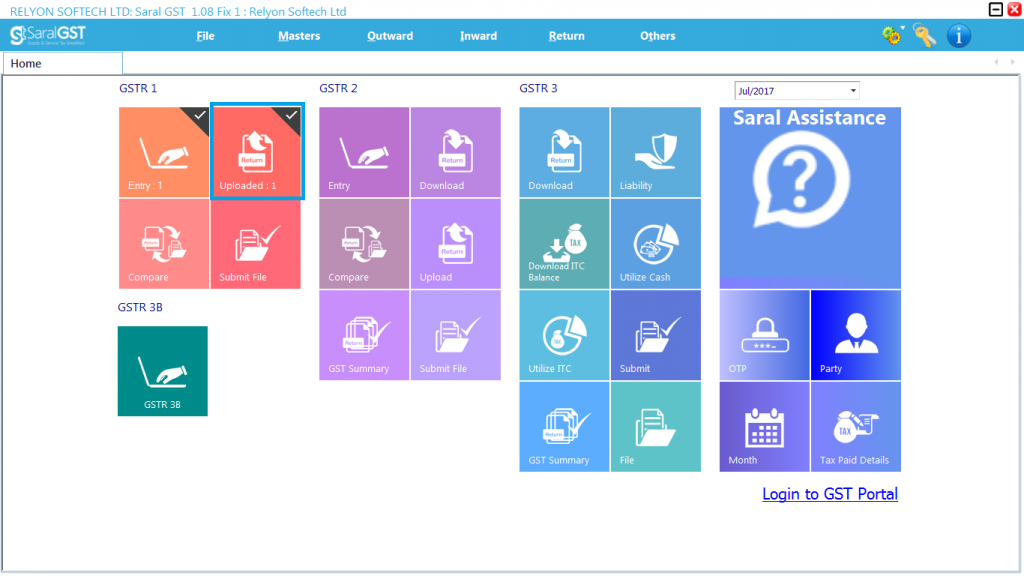

Once that it is done, the details in Saral GST is now ready for GSTN upload. To upload the details to GSTN, the steps are as below:-

- Create JSON file then

- validate the JSON file

- upload the JSON file to GSTN

Before creating the JSON File, some master settings are required to be done.

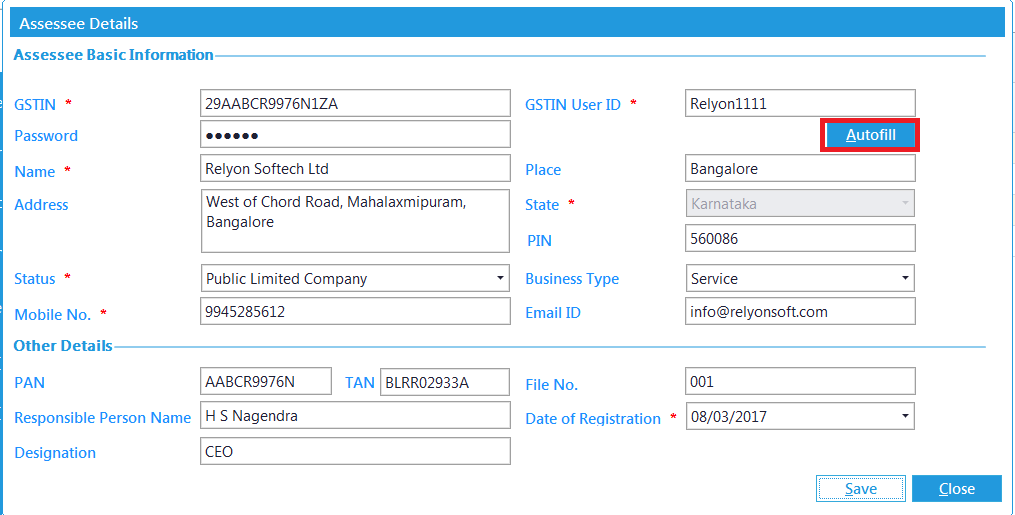

Firstly provide the GSTN User Id and Password in Assessee Master. Here option is provided to Auto Fetch the details of the Assessee from GSTN, on providing the GSTIN, GSTIN User Id & Password.

Goto Master -> Assessee Master. Enter the GSTIN, GSTIN User Id & Password and click on Autofill. All mandatory information will be auto fetched.

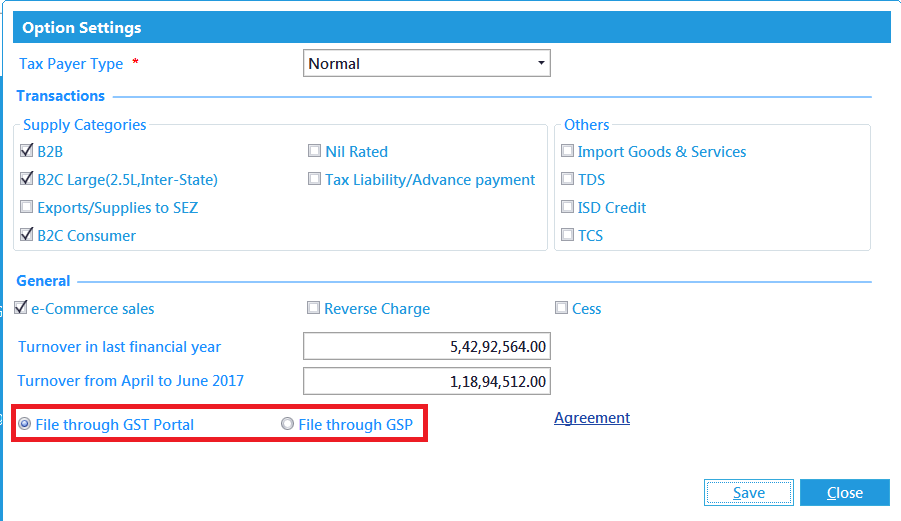

Next, Settings to be done for the type of return filing. Here, provide all the details required and select on filing option.

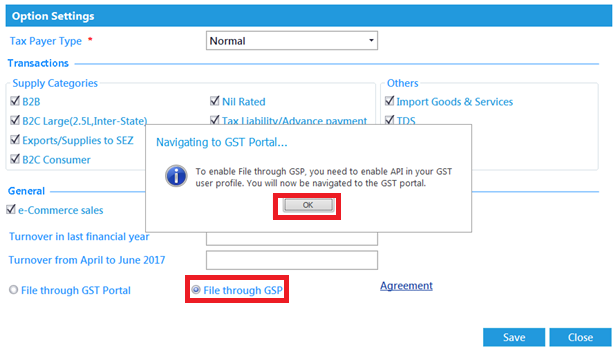

Select “File through GST Portal” is an offline process were filing will be done through GSTN portal and “File through GSP” is an online process were filing will be done through GSP (GST Suvidha Providers) network and is a paid service.

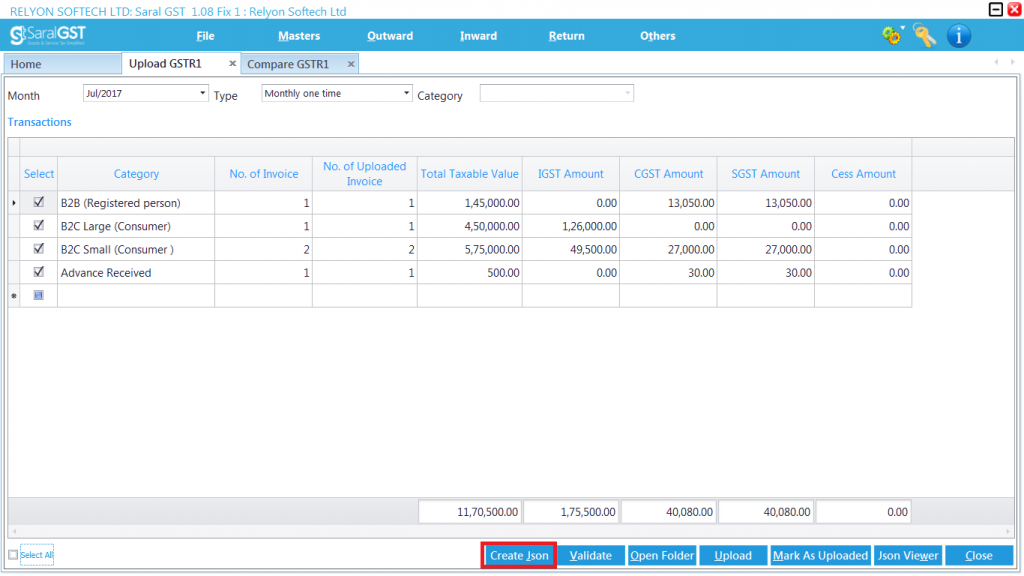

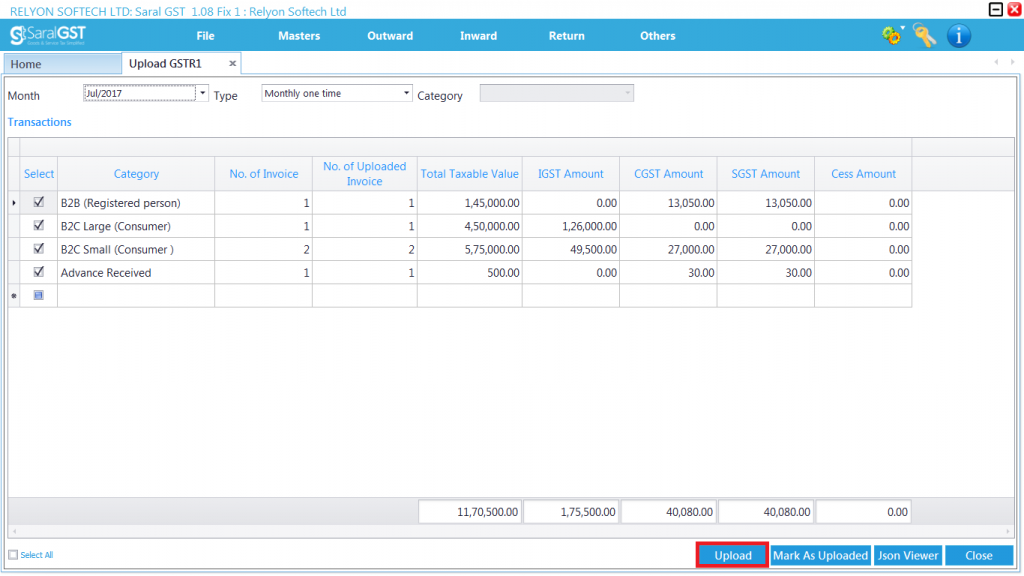

To Create JSON file: goto GSRT 1-> Upload

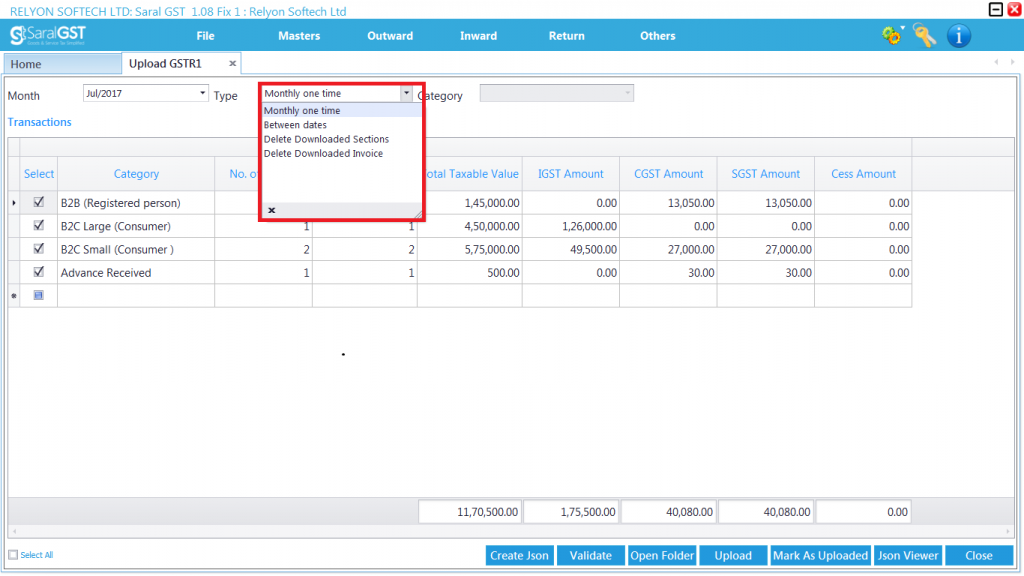

Here, select the type of Upload. The different types are as follows:-

– Monthly one time-> If uploading the complete data once in a month

– Between Dates -> If uploading the data between the month, for selected category and invoices.

– Delete Downloaded Sections -> To Delete the complete the Category data that is uploaded in GSTN

– Delete downloaded Invoice -> To Delete the selected invoices that are uploaded in GSTN.

Now, click on Create JSON Button to create the file.

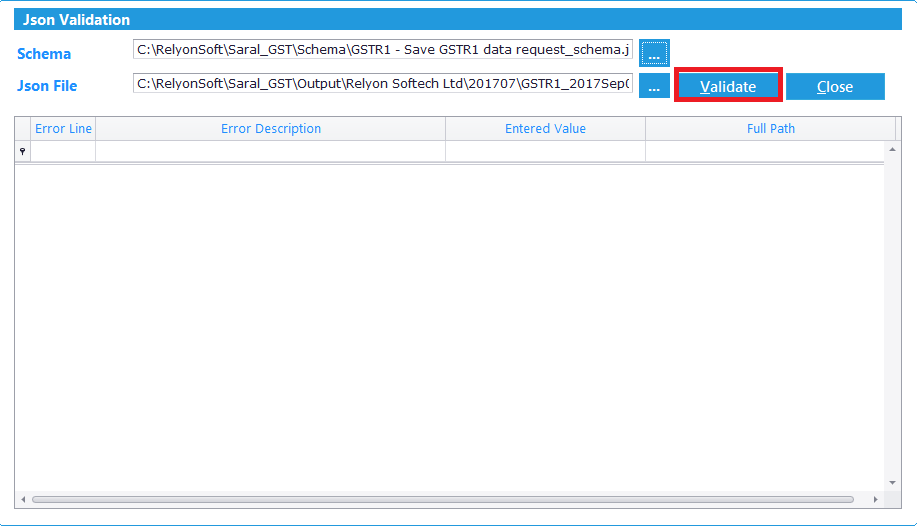

On creation of the file, Click on Validate. This will lead to a validation screen where the data in the file created is validated against the schema. If any error is found the same will be shown which has to be rectified and again validate till no error is found.

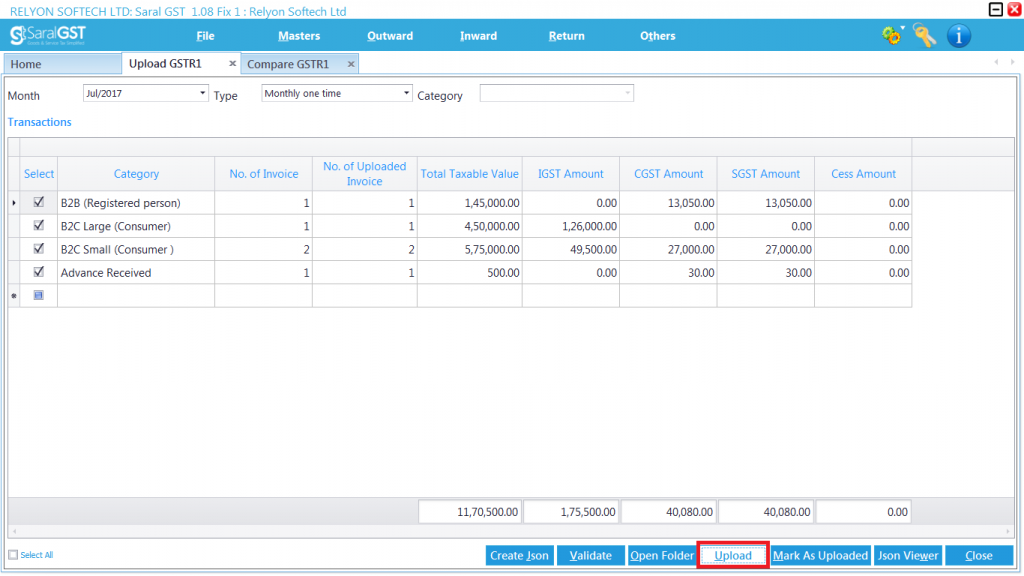

Upload Offline (File through GST Portal): After validation, now the file is ready to be uploaded to GSTN. Click on Upload to upload it to GSTN.

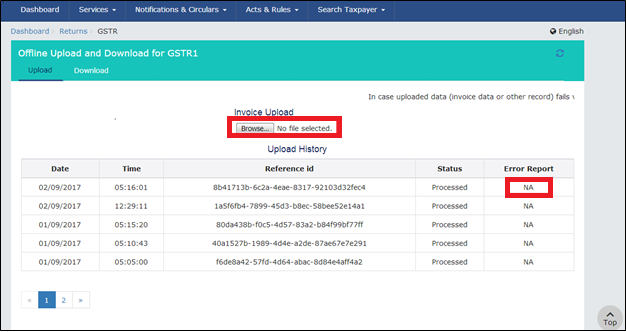

You will be redirected to the GST portal login. The JSON file created will be uploaded in the GST Portal as shown in below screen. On upload, if the Error Report shows as NA, then JSON file is uploaded successfully.

Upload Online (File through GSP): If the filing is done through GSP, firstly under Master -> Option Setting the option has to be set to “File through GSP”. After the setting, certain API has to be enabled in the GST portal. Hence, you will be redirected to GST Portal.

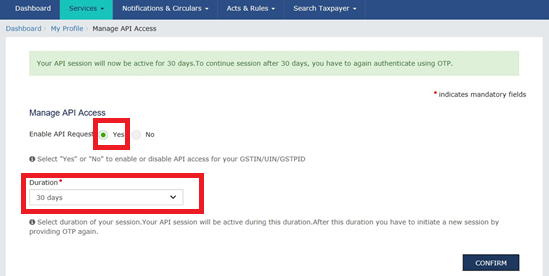

In the GST Portal, enable the API request by selecting YES and set the duration for which this setting will be active. The maximum duration will be 30 Days and the minimum being 6 Hours. Click on Confirm to save the settings.

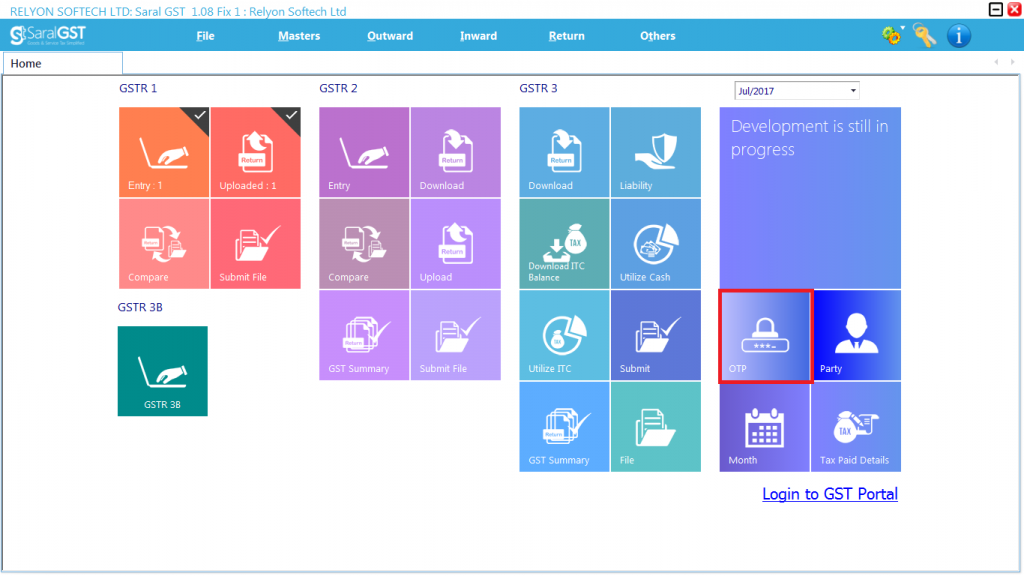

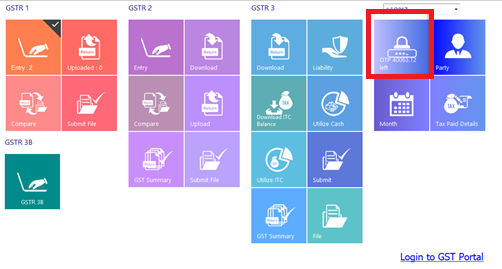

After API is enabled in GST portal, an OTP setting has to be done in Saral GST. Goto OTP is shown in the dashboard.

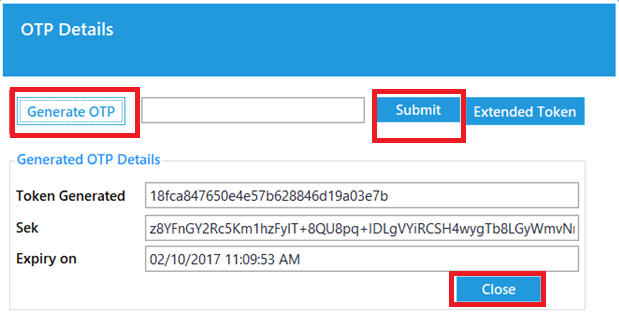

Here, click on Generate OTP. An OTP will be sent to the registered mobile number which was given during GSTIN registration. Enter the OTP and click on Submit. The OTP will be saved and will be valid for the duration given in the GST portal during API enablement (Maximum 30 Days).

The expiry date of the OTP will be shown on screen.

On the dashboard, the time left for OTP expiry will be shown.

After these settings, goto GSRT1 -> Upload. Here, select the type of upload (i.e Monthly one time or Between Dates) and click on Upload.

Note: Here, Manual JSON file creation is not required.

When Upload button is clicked, JSON file will auto-created in the backend and automatically uploaded to GSTN.

A message will be shown on successful upload of the file to GSTN.

That’s it for the second part. If you have any questions or comments, ask them below.

You can also learn about GSTR-1 in general